IRS 1120 - Schedule G 2009 free printable template

Show details

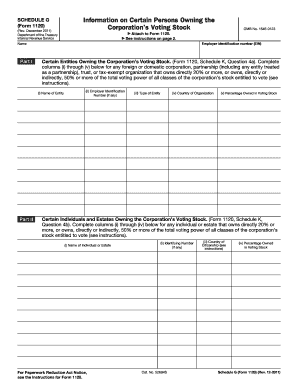

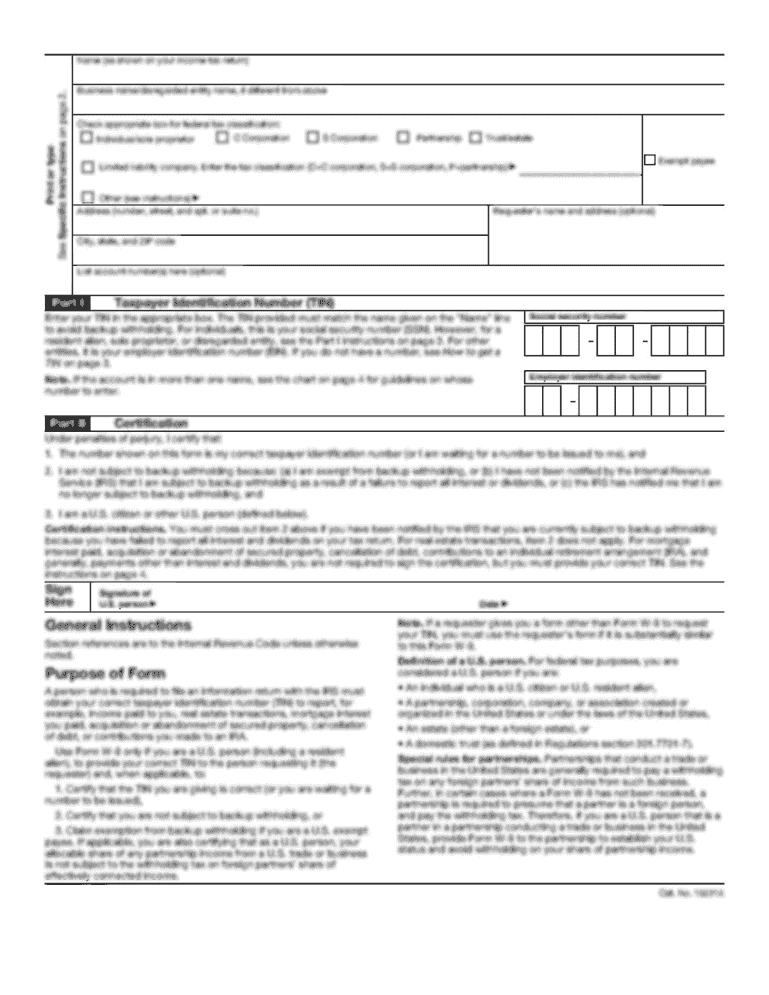

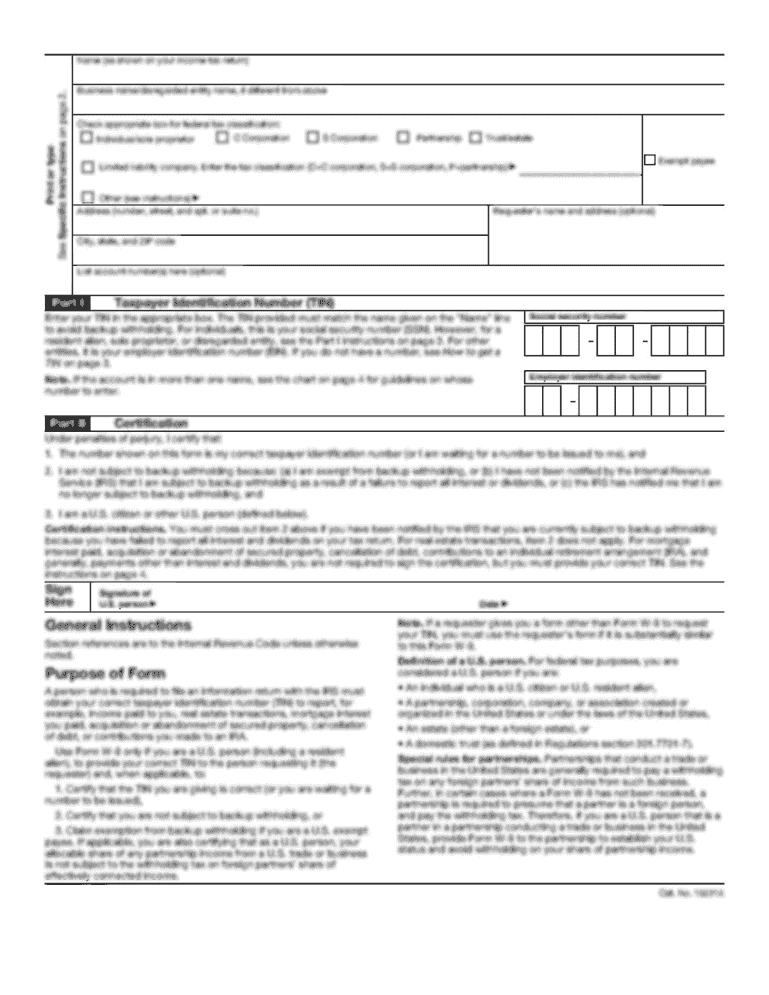

Information on Certain Persons Owning the Corporation s Voting Stock SCHEDULE G Form 1120 Department of the Treasury Internal Revenue Service Attach to Form 1120. Ii Identifying Cat. No. 52684S iii Country of Citizenship see in Voting Stock Schedule G Form 1120 2009 General Instructions Purpose of Form Use Schedule G Form 1120 to provide information applicable to certain entities individuals and estates that own directly 50 or more of the total ...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 1120 - Schedule G

Edit your IRS 1120 - Schedule G form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 1120 - Schedule G form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 1120 - Schedule G online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit IRS 1120 - Schedule G. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

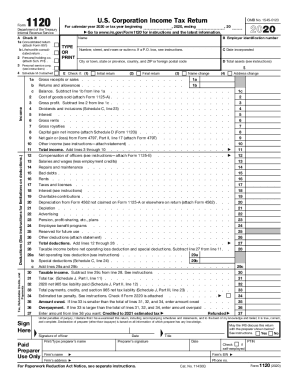

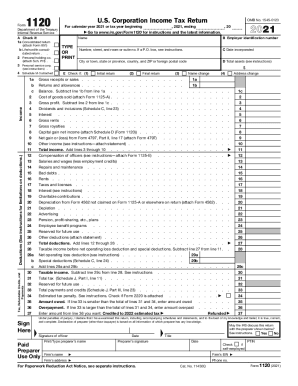

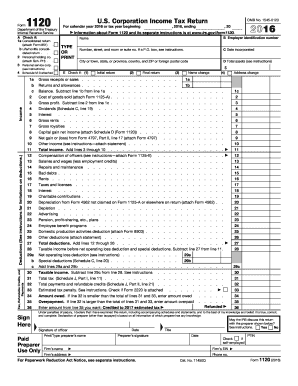

IRS 1120 - Schedule G Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 1120 - Schedule G

How to fill out IRS 1120 - Schedule G

01

Begin by obtaining IRS Form 1120-Schedule G from the IRS website or your tax preparation software.

02

Review the instructions for Schedule G to ensure you understand the requirements.

03

Fill in your corporation's name, address, and Employer Identification Number (EIN) at the top of the form.

04

Complete Part I by providing information about the corporation's activities, including the type of business and principal product or service.

05

Move on to Part II, where you will list any foreign ownership details if applicable, including foreign corporations or partnerships that own at least 25% of your corporation.

06

If your corporation engages in a specific industry that requires additional reporting, ensure that you complete any relevant sections as outlined in the Schedule G instructions.

07

Review all entries for accuracy and completeness to avoid mistakes.

08

Sign and date the form before submission, and keep a copy for your records.

Who needs IRS 1120 - Schedule G?

01

Corporations that are required to file IRS Form 1120 and have certain types of activities or ownership situations.

02

Tax-exempt organizations that conduct certain activities may also need to file Schedule G.

03

Corporations with foreign ownership or partnerships must fill out this form to disclose ownership information.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between form 1120 and Schedule C?

C Corporation Form 1120 is a little more involved than a Schedule C; it asks more questions and you must provide balance sheet information for the beginning and end of the tax period. Form 1120 is not filed as part of your personal income tax return.

Is Schedule C the same as 1120?

The five-page Form 1120S is essentially your business's tax return. When a business is taxed as a sole proprietorship, its profit and loss is reported on Schedule C. In an S-Corp, Form 1120S replaces Schedule C as the way the business's profit or loss is reported to the IRS.

How do I report dividends paid to shareholders on 1120?

Where do I enter dividends received by or paid by the corporation on an 1120 return? Enter dividends received by the corporation, and special deductions, on screen C, Schedule C Dividends Received. The Dividends Received Deduction Worksheet (Wks DRD) is generated from data entered in fields 3-1, 3-2, 3-3, and 3-4.

Does form 1120 have a Schedule C?

C corporations report their annual dividend income from investments in other companies on 1120 Schedule C. Through the dividends received deduction, C corporations can write off a percentage of dividend income. The deduction calculation depends on the amount of another corporation your corporation owns.

What is reported on 1120?

Use Form 1120, U.S. Corporation Income Tax Return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS 1120 - Schedule G to be eSigned by others?

Once you are ready to share your IRS 1120 - Schedule G, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I sign the IRS 1120 - Schedule G electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your IRS 1120 - Schedule G in minutes.

How can I fill out IRS 1120 - Schedule G on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your IRS 1120 - Schedule G. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is IRS 1120 - Schedule G?

IRS 1120 - Schedule G is a form used by corporations to report information regarding shareholders and stock ownership, as part of their annual corporate tax return.

Who is required to file IRS 1120 - Schedule G?

Corporations that have undergone an ownership change or are closely held must file IRS 1120 - Schedule G, particularly if they are required to provide information about their shareholders.

How to fill out IRS 1120 - Schedule G?

To fill out IRS 1120 - Schedule G, a corporation must provide details about its stock ownership structure, including names and addresses of shareholders, the number of shares owned, and types of stock held.

What is the purpose of IRS 1120 - Schedule G?

The purpose of IRS 1120 - Schedule G is to gather information about the corporation's stock ownership and shareholders to ensure compliance with tax regulations and assess any potential tax obligations.

What information must be reported on IRS 1120 - Schedule G?

The information that must be reported on IRS 1120 - Schedule G includes the names and addresses of shareholders, the number of shares each shareholder owns, and the type of stock they hold.

Fill out your IRS 1120 - Schedule G online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 1120 - Schedule G is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.