Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

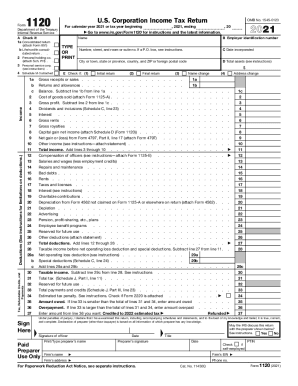

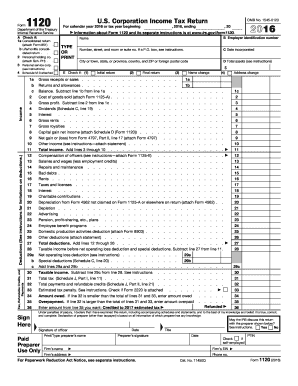

What is schedule g form 1120?

Schedule G is a supplemental schedule that is filed along with Form 1120, the U.S. Corporation Income Tax Return. It is used to report information related to "Information on Certain Persons Owning the Corporation's Voting Stock," which includes details about individuals or entities with ownership interests in the corporation.

The purpose of Schedule G is to provide the Internal Revenue Service (IRS) with information about owners who may potentially have a significant impact on the corporation's decision-making processes. This schedule helps the IRS determine if certain individuals or entities need additional scrutiny or compliance checks.

Some of the information required on Schedule G includes the name, address, and taxpayer identification number of the individuals or entities owning more than 20% of the voting stock of the corporation. Additionally, it may require information about any transactions or relationships between the corporation and those owners.

It is important to note that Schedule G is only required for certain corporations and not for all filers of Form 1120. The instructions for Form 1120 and Schedule G provide further details on whether an entity needs to file Schedule G or not.

Who is required to file schedule g form 1120?

Schedule G, Form 1120, is required to be filed by corporations that have certain information to report regarding their organization, reorganizations, acquisitions, and dispositions during the tax year. Specifically, the following entities are required to file Schedule G:

1. Domestic Corporations: All domestic corporations that file Form 1120, U.S. Corporation Income Tax Return, must complete and attach Schedule G.

2. Foreign Corporations: Foreign corporations engaged in a U.S. trade or business and filing Form 1120-F, U.S. Income Tax Return of a Foreign Corporation, need to file Schedule G as well.

It is important to consult the official IRS guidelines or seek professional assistance to ensure accurate filing and compliance with all tax requirements.

How to fill out schedule g form 1120?

Filling out Schedule G - Information on Certain Persons Owning the Corporation’s Voting Stock is a vital part of completing Form 1120, the U.S. Corporation Income Tax Return. This schedule is used to provide information about individuals who own at least 20% of the voting stock or share in the corporation. Here are step-by-step instructions on how to fill out Schedule G:

1. Obtain the necessary documents: Gather the corporation’s stock ownership records, such as stock ledgers, stock certificates, or other related documents that provide information on the corporation’s shareholders.

2. Identify significant shareholders: Identify individuals who meet the ownership criteria. Schedule G requires details about each person who directly or indirectly owns 20% or more of the corporation’s voting stock.

3. Fill out Part I - Identification of Interested Parties: Provide the full legal name, address, and taxpayer identification number (TIN) for each person who owned at least 20% of the voting stock at any time during the tax year. Indicate the relationship of the individual to the corporation (e.g., officer, director, or shareholder).

4. Fill out Part II - Information on Certain Beneficial Owners of the Corporation’s Stock: Provide information on any actual or potential beneficial owners of the corporation’s stock who held more than 5% of the corporation’s voting stock at any time during the tax year. Include their full legal names, addresses, and TINs.

5. Fill out Part III - Additional Information: This section requires the disclosure of any partnerships, estates, trusts, or corporations that directly or indirectly own more than 50% of the corporation’s voting stock. Provide the name, address, and TIN of each entity as required.

6. Review and double-check: Ensure that all information provided on the schedule is accurate and complete. Any errors or inconsistencies may cause delays or trigger audits.

Please note that it is important to consult the instructions provided with Schedule G and Form 1120 to ensure compliance with any specific requirements or changes that could impact the completion of the form. Additionally, seeking professional advice from a qualified tax professional or accountant is highly recommended to ensure accuracy and to address any specific circumstances related to your corporation.

What is the purpose of schedule g form 1120?

Schedule G (Form 1120) is used by corporations to provide information on the total income tax liability and payments made throughout the tax year. It is used to determine if the corporation has underpaid or overpaid their estimated taxes and calculates any balance due or overpayment of tax. Schedule G is also used to report any tax credits and carryforward amounts that may be applicable to the corporation.

What information must be reported on schedule g form 1120?

Schedule G (Form 1120) is used to report information about certain organizations and partnerships that the corporation had interests in during the tax year. The specific information that must be reported on Schedule G includes:

1. Identifying Information: This includes the name, address, and Employer Identification Number (EIN) of the organization or partnership.

2. Ownership Percentage: The percentage of ownership or interest that the corporation holds in the organization or partnership.

3. Nature of Interest: The description of the type of interest the corporation has in the organization or partnership (e.g., stock, partnership interest, or membership interest).

4. Income or Loss: The corporation's share of the organization or partnership's income or loss for the tax year.

5. Separate or Consolidated Return: The indication of whether the corporation filed a separate or consolidated return with the organization or partnership.

6. Schedule L Reporting: If the corporation is required to complete Schedule L (Balance Sheets per Books) and has interests in more than one organization or partnership, additional information regarding the specific balance sheet line item amounts must be reported on Schedule G.

It is important to note that Schedule G is only required if the corporation had interests in organizations or partnerships during the tax year.

When is the deadline to file schedule g form 1120 in 2023?

The deadline to file Schedule G (Form 1120) for the tax year 2023 would typically be the same as the deadline for filing the Form 1120 itself. For most corporations, including C corporations, the regular deadline for filing Form 1120 is the 15th day of the fourth month following the end of the tax year. Therefore, if the tax year ends on December 31, 2023, the deadline to file Schedule G (Form 1120) would be April 15, 2024, unless that date falls on a weekend or holiday, in which case it will be the next business day. However, it is always recommended to consult the Internal Revenue Service (IRS) or a tax professional for the most accurate and up-to-date information regarding filing deadlines.

What is the penalty for the late filing of schedule g form 1120?

The penalty for the late filing of Schedule G form 1120, which is used for information on certain organizations and business activities, can vary depending on the specific circumstances. As of 2021, the penalty rate is $435 per month or part of a month for each shareholder or member, up to a maximum of 12 months. However, if the entity's total gross receipts are less than $5 million, the penalty is reduced to $195 per shareholder or member per month or part of a month, up to a maximum of 12 months. It is important to note that these penalty rates are subject to change, so it is recommended to consult the official IRS guidelines or seek professional advice for up-to-date information.

How can I send schedule g form 1120 to be eSigned by others?

Once you are ready to share your 1120 schedule g instructions form, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I sign the schedule g form 1120 instructions electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your 2019 form 1120 schedule g in minutes.

How can I fill out what is schedule g on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your schedule g tax form. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.